6 min read

6 min readBy Jia Taylor, Content Marketing Lead

Takeaways:

- Climate change is impacting homeowners across different U.S. markets.

- Unison is factoring climate change scenarios into its investments.

- Climate-change risks are leading homeowners to take new measures to keep their assets protected.

Climate change is projected to shape the course of history over the next century, and homeowners across the country are already beginning to feel the effects.

From rising sea levels to wildfires to hurricanes and floods, societies have undergone fundamental changes in how people live, changing the way many homeowners think about their largest financial asset.

In parts of the West, the growing danger of wildfires is already making it harder for homeowners to get insurance, while future sea level rise poses serious threats to the viability of coastal communities.

To understand how climate-related risks are having an impact on housing values and the cost of homeownership, researchers at Unison analyze data to identify potential risks and further improve its active management. How will climate change impact housing value and how can homeowners protect their assets in the face of climate change?

Rising Sea Levels

The National Oceanic and Atmospheric Administration (NOAA) reports that sea levels on the U.S. coastline will rise, on average, 10 to 12 inches over the next three decades — in the same time it will take to pay off today’s 30-year mortgage. The projected increase is especially alarming given that it took over a century of climate change for sea levels to rise that much to the present day.

According to a study by the University of Southern California, 13 million people in the U.S. alone, could be forced to relocate due to rising sea levels by 2100.

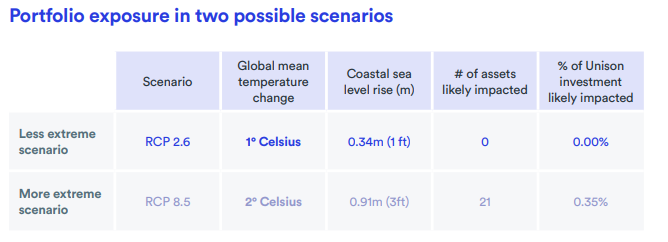

Unison is already factoring climate change scenarios into its investments. Unison has built proprietary technology to track and monitor sea level rise. In Unison’s 2021 Responsible Investing Report, Unison has overlaid its geographically diverse portfolio with the projectons of sea level rise issued by the NOAA.

The analysis shows that in a scenario where sea levels rise by 0.34 meters, none of Unison’s assets currently under management would be impacted by this specific climate risk. Under a more extreme scenario of a 0.91 meter sea level rise, approximately 0.35% of Unison’s investments would be affected.

Rising Temperatures

Rising global temperatures are triggering climate-related events including dangerous levels of wind, rain and flooding. NOAA’s National Centers for Environmental Information (NCEI) reports that 2020 was a historic year of extremes — with 22 separate events causing approximately $95 billion in damages. 2021 followed the same trend; data collected by NOAA shows that last June was the hottest on record across the United States, while this past July was the hottest July worldwide.

An increase in temperature can also have a direct impact on the expense of owning a home, such as higher utility costs. Higher temperatures mean more people using electricity for air-conditioning to stay cool or an increase in water usage to maintain lawns. The more demand for these resources, the more expensive they become.

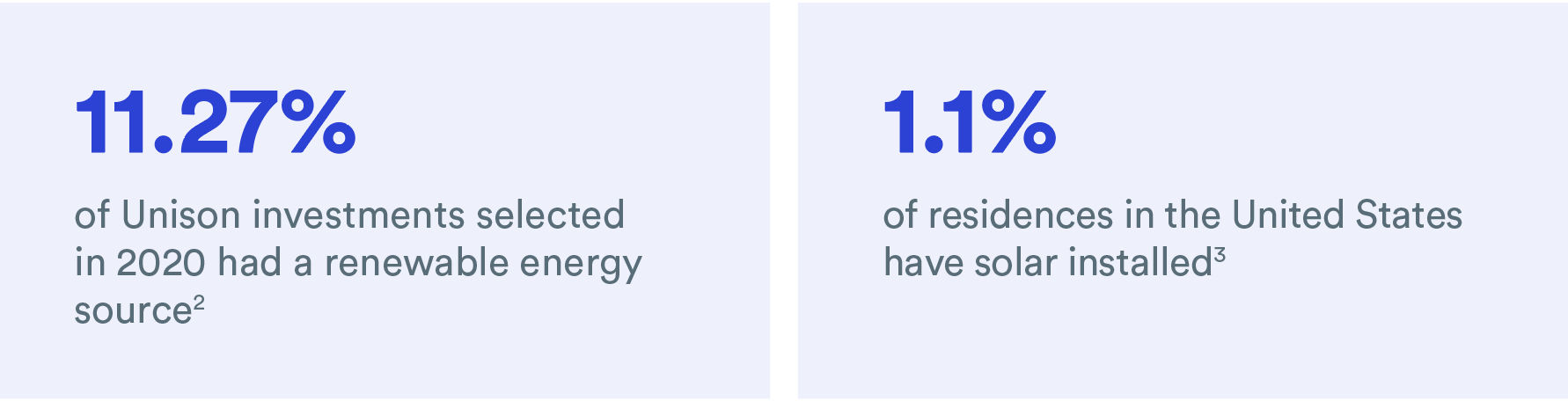

Unison data shows that transitioning to renewable energy sources such as solar energy, improves homeowners’ carbon footprints and property marketability. Solar shading also helps keep buildings cool by reducing heat gain. According to the U.S. Energy Information Administration: Monthly Energy Review,[1] residential buildings consumed approximately 22% of the energy produced in the United States in 2020 and were responsible for 20% of total U.S. emissions, or 902 million metric tons of carbon monoxide.

Wildfires

The 2020 California wildfires destroyed millions of acres and thousands of structures, causing unprecedented devastation to people’s homes - making it the worst wildfire season on record. The disasters also sent real estate prices climbing in the nearby areas unaffected by fires, as those rendered without homes were competing with city buyers, driving prices up even further.

If you live in an area that’s prone to wildfires, some actions can help ensure the safety of your home. One way to be prepared is to read through your current insurance policy or any new policies you are considering and get supplemental fire insurance if necessary.

Floods

Homes in coastal areas that are prone to flooding are somewhat ironically desirable to many buyers for their gorgeous views of the water; their prices are correspondingly high. A 2021 Redfin study found that homes with a high flood risk sold for 13.6% more than homes with low flood risk during the first quarter of 2021, nearly double the premium of 7.2% in the first quarter of 2019. The reason? Experts say homebuyers may not be aware that they’re purchasing a home in a flood plain or just don’t view it as an immediate danger.

Research by First Street Foundation reports that 23.5 million properties are at risk of flooding over the next 30 years. Homebuyers can check First Street Foundation’s Flood Factor Tool, for flood risk data in their neighborhoods.

Hurricanes

National Public Radio (NPR) reports that the 2021 Atlantic hurricane season was the third most active year in history. Recent studies indicate that there has been an increased number of Atlantic hurricanes over the past 20 years.

It also means a higher risk of damage to property in the path of these storms. While typical home insurance policies cover sudden water damage caused by pipes or water heaters, floods caused by natural calamities such as hurricanes require a separate policy. To apply, your community must be registered in the National Flood Insurance Program (NFIP).

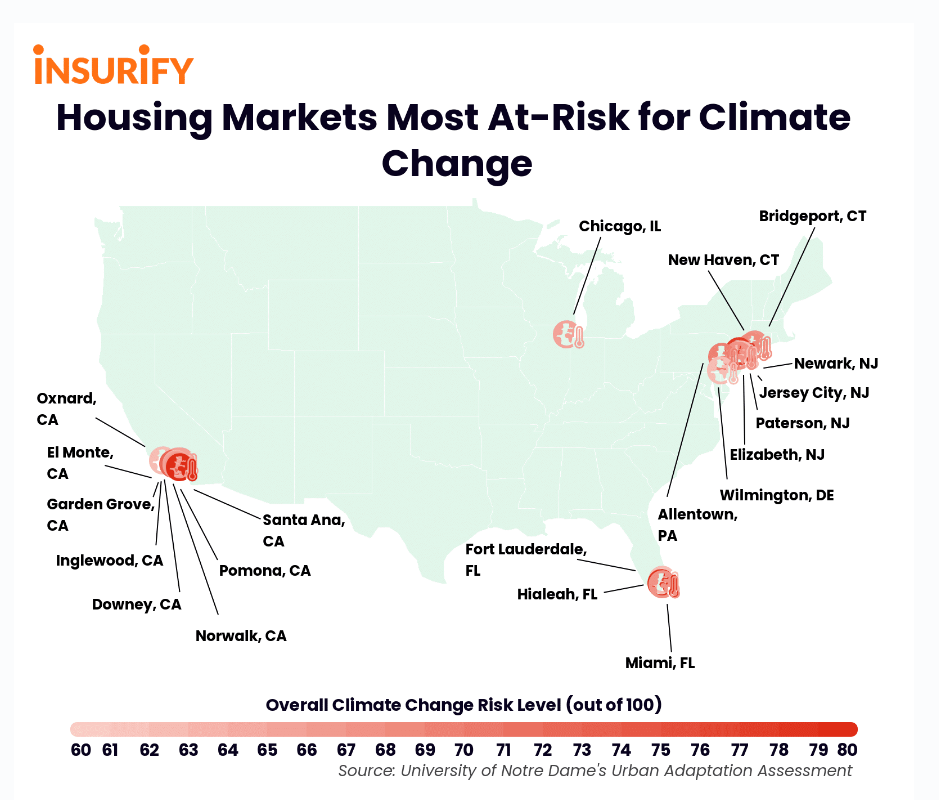

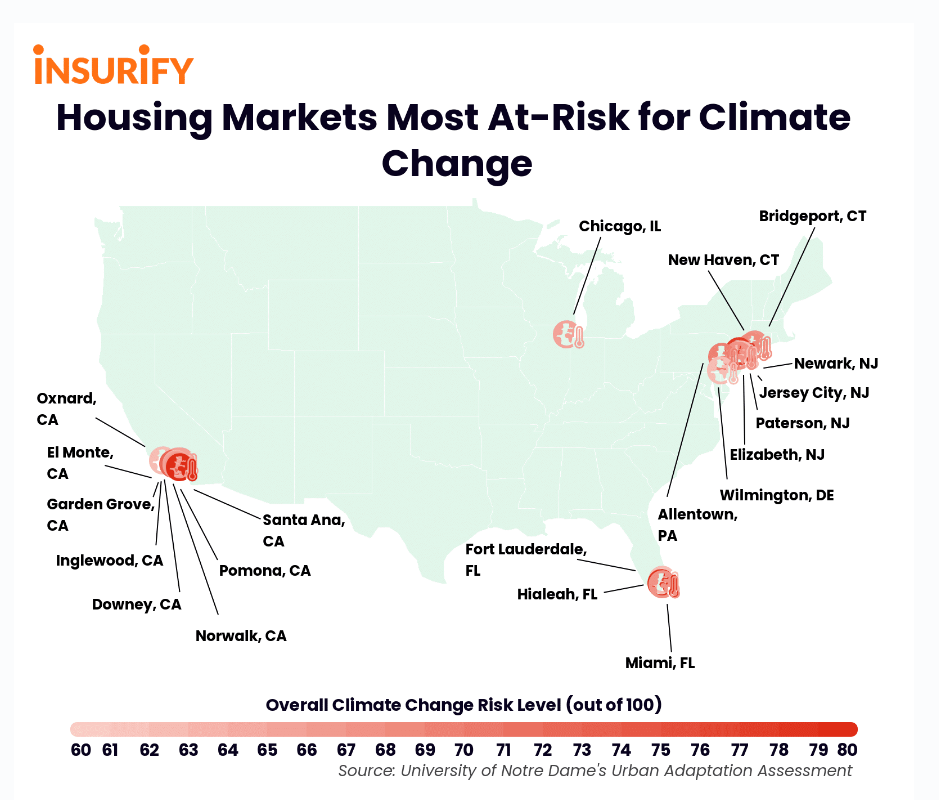

What Housing Markets Are Most At-Risk to Climate Change?

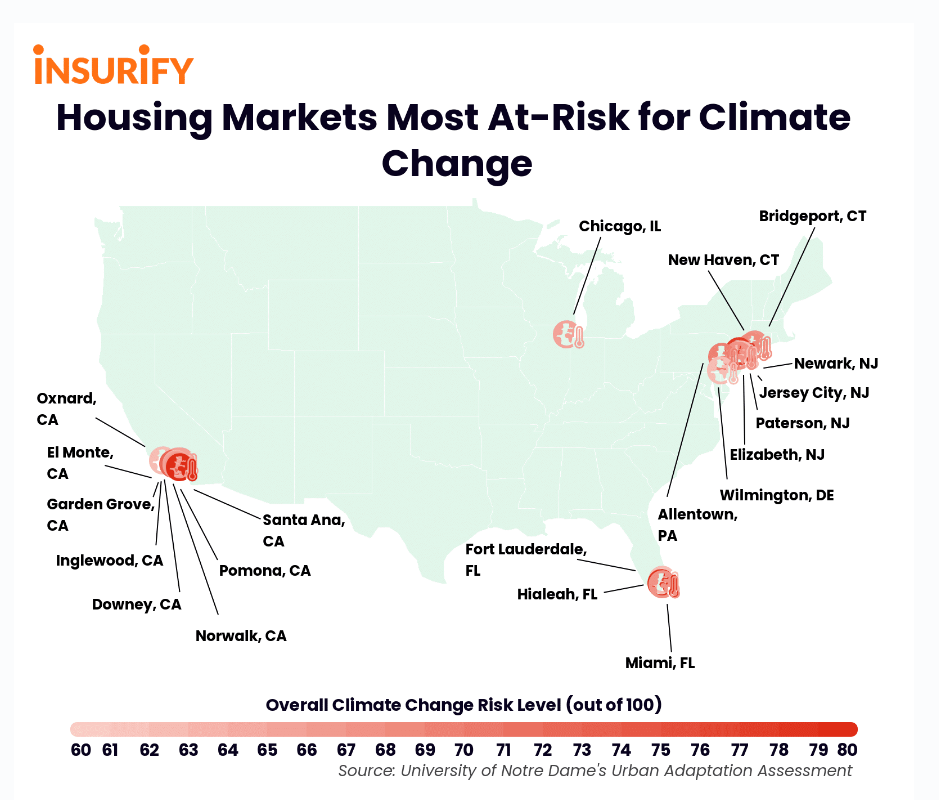

According to data from Insurify, coastal cities, perhaps unsurprisingly, are most at risk to climate change. As of 2020, the top five housing markets most at-risk for climate change include:

1. Santa Ana, CA

2. Hialeah, FL

3. Paterson, NJ

4. Inglewood, CA

5. Allentown, PA

Future Impacts of Climate Change

Climate change risks and more frequent extreme events like flooding and wildfires could impact your home value in the future in several ways including:

- Increased Home Damage - rebuilding a home after a calamity can result in large-scale financial loss, making it difficult for a homeowner to fully recover financially.

- Decreased Home Values - frequent tidal flooding caused by rising sea levels has been found to diminish the value of homes in at-risk areas.

- Higher Insurance Premiums - insurers are mitigating the risk of climate change by raising home insurance premiums, especially in areas prone to wildfires or floods.

- Higher Property Taxes - a study by the U.S. News and World Report finds that due to many people leaving some coastal communities because of tidal flooding the tax base is shrinking, causing a property tax increase to pay for infrastructures.

The Bottom Line

The unpredictability of climate change makes it difficult to evaluate the risk, but taking action early can make a difference. If you’re buying a home, try to think ahead. Consider the potential risks of climate-change hazards when deciding where to live.

- Check the address on sites such as Climate Check, Flood Factor or Attom Data Solutions Home Disclosure Report for information on storms, floods, and wildfires.

- Ask the seller and listing agent for information about previous flood or fire damage.

- Ask a home inspector to keep an eye out for evidence of previous storm or fire damage.

- Be aware of the full cost of ownership, including maintenance and insurance and how those costs could rise.

- Request a homeowners insurance estimate as early as you can in order to determine its affordability.

- When renovating your home, consider potential climate change impacts likely to affect your area.

- Consider adding storm-resistant features like hurricane shelters, stronger windows, mesh coverings for vents (in fire-prone areas) or solar panels as a source of renewable energy.

Unison’s Home Partnership Team works alongside Unison’s homeowners to help them navigate their homeownership journey, and can provide additional resources.

3. Paterson, NJ

4. Inglewood, CA

5. Allentown, PA

Future Impacts of Climate Change

Climate change risks and more frequent extreme events like flooding and wildfires could impact your home value in the future in several ways including:

- Increased Home Damage - rebuilding a home after a calamity can result in large-scale financial loss, making it difficult for a homeowner to fully recover financially.

- Decreased Home Values - frequent tidal flooding caused by rising sea levels has been found to diminish the value of homes in at-risk areas.

- Higher Insurance Premiums - insurers are mitigating the risk of climate change by raising home insurance premiums, especially in areas prone to wildfires or floods.

- Higher Property Taxes - a study by the U.S. News and World Report finds that due to many people leaving some coastal communities because of tidal flooding the tax base is shrinking, causing a property tax increase to pay for infrastructures.

The Bottom Line

The unpredictability of climate change makes it difficult to evaluate the risk, but taking action early can make a difference. If you’re buying a home, try to think ahead. Consider the potential risks of climate-change hazards when deciding where to live.

- Check the address on sites such as Climate Check, Flood Factor or Attom Data Solutions Home Disclosure Report for information on storms, floods, and wildfires.

- Ask the seller and listing agent for information about previous flood or fire damage.

- Ask a home inspector to keep an eye out for evidence of previous storm or fire damage.

- Be aware of the full cost of ownership, including maintenance and insurance and how those costs could rise.

- Request a homeowners insurance estimate as early as you can in order to determine its affordability.

- When renovating your home, consider potential climate change impacts likely to affect your area.

- Consider adding storm-resistant features like hurricane shelters, stronger windows, mesh coverings for vents (in fire-prone areas) or solar panels as a source of renewable energy.

Unison’s Home Partnership Team works alongside Unison’s homeowners to help them navigate their homeownership journey, and can provide additional resources.

4. Inglewood, CA

5. Allentown, PA

Future Impacts of Climate Change

Climate change risks and more frequent extreme events like flooding and wildfires could impact your home value in the future in several ways including:

- Increased Home Damage - rebuilding a home after a calamity can result in large-scale financial loss, making it difficult for a homeowner to fully recover financially.

- Decreased Home Values - frequent tidal flooding caused by rising sea levels has been found to diminish the value of homes in at-risk areas.

- Higher Insurance Premiums - insurers are mitigating the risk of climate change by raising home insurance premiums, especially in areas prone to wildfires or floods.

- Higher Property Taxes - a study by the U.S. News and World Report finds that due to many people leaving some coastal communities because of tidal flooding the tax base is shrinking, causing a property tax increase to pay for infrastructures.

The Bottom Line

The unpredictability of climate change makes it difficult to evaluate the risk, but taking action early can make a difference. If you’re buying a home, try to think ahead. Consider the potential risks of climate-change hazards when deciding where to live.

- Check the address on sites such as Climate Check, Flood Factor or Attom Data Solutions Home Disclosure Report for information on storms, floods, and wildfires.

- Ask the seller and listing agent for information about previous flood or fire damage.

- Ask a home inspector to keep an eye out for evidence of previous storm or fire damage.

- Be aware of the full cost of ownership, including maintenance and insurance and how those costs could rise.

- Request a homeowners insurance estimate as early as you can in order to determine its affordability.

- When renovating your home, consider potential climate change impacts likely to affect your area.

- Consider adding storm-resistant features like hurricane shelters, stronger windows, mesh coverings for vents (in fire-prone areas) or solar panels as a source of renewable energy.

Unison’s Home Partnership Team works alongside Unison’s homeowners to help them navigate their homeownership journey, and can provide additional resources.

5. Allentown, PA

Future Impacts of Climate Change

Climate change risks and more frequent extreme events like flooding and wildfires could impact your home value in the future in several ways including:

- Increased Home Damage - rebuilding a home after a calamity can result in large-scale financial loss, making it difficult for a homeowner to fully recover financially.

- Decreased Home Values - frequent tidal flooding caused by rising sea levels has been found to diminish the value of homes in at-risk areas.

- Higher Insurance Premiums - insurers are mitigating the risk of climate change by raising home insurance premiums, especially in areas prone to wildfires or floods.

- Higher Property Taxes - a study by the U.S. News and World Report finds that due to many people leaving some coastal communities because of tidal flooding the tax base is shrinking, causing a property tax increase to pay for infrastructures.

The Bottom Line

The unpredictability of climate change makes it difficult to evaluate the risk, but taking action early can make a difference. If you’re buying a home, try to think ahead. Consider the potential risks of climate-change hazards when deciding where to live.

- Check the address on sites such as Climate Check, Flood Factor or Attom Data Solutions Home Disclosure Report for information on storms, floods, and wildfires.

- Ask the seller and listing agent for information about previous flood or fire damage.

- Ask a home inspector to keep an eye out for evidence of previous storm or fire damage.

- Be aware of the full cost of ownership, including maintenance and insurance and how those costs could rise.

- Request a homeowners insurance estimate as early as you can in order to determine its affordability.

- When renovating your home, consider potential climate change impacts likely to affect your area.

- Consider adding storm-resistant features like hurricane shelters, stronger windows, mesh coverings for vents (in fire-prone areas) or solar panels as a source of renewable energy.

Unison’s Home Partnership Team works alongside Unison’s homeowners to help them navigate their homeownership journey, and can provide additional resources.

[1] U.S. Energy Information Administration: Monthly Energy Review January through December 2021

[2] Unison Investment Management: Internal Calculations 2021

[3] Stanford University DeepSolar Database, originally published by Joule December 2018

The content on this page provides general consumer information. It is not legal or financial advice. Unison has provided these links for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of the other websites.

About the Author

Unison

We're the pioneers of equity sharing, offering innovative ways for you to gain access to the equity in your home. For more than a decade, we have helped over 12,000 homeowners to pursue their financial goals, from home renovations to debt consolidation, retirement savings, and more.