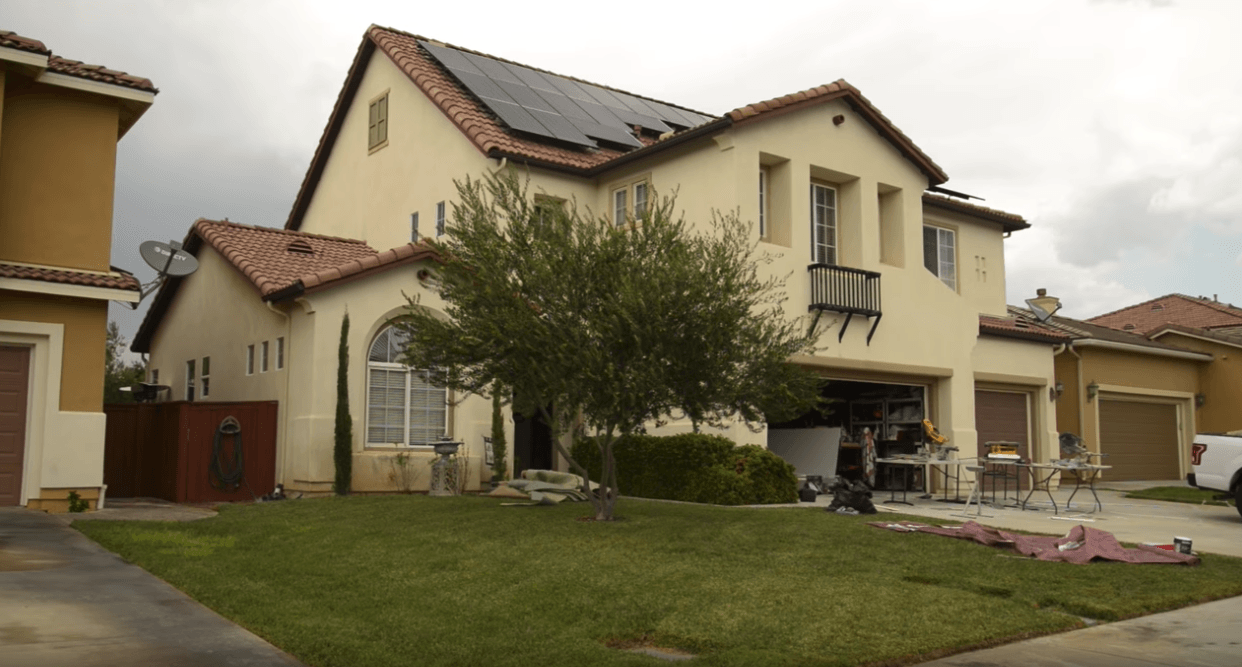

Ed is a father, a husband, and a homeowner who needed to find a way to pay off debt. When he found the Unison Equity Sharing Agreement, he realized that not only could he completely pay off all his debt, but he could also make some long-awaited home improvements – that would allow him and his family to enjoy their home even more. Today he is very happy with his remodeled home and grateful for the newfound financial flexibility he obtained with help from Unison.

Weighed Down By Frustrating Debt

Ed had accrued some credit card debt which was starting to infringe on his monthly budget and cause some serious stress to accumulate. It felt like a massive weight on his shoulders.

He wanted to destroy that debt, so he began looking into options for reducing it or paying it off faster. What he found was that options like a HELOC or mortgage refinance would simply mean swapping one type of debt for another. “We were considering a home equity line of credit or a refinance,” he said. “But all that meant was that I would trade one payment for another payment.”

He needed a better option – one that would allow him to truly reach financial freedom with no additional monthly payments. That’s when he came across Unison.

Considering A New Option: Unison

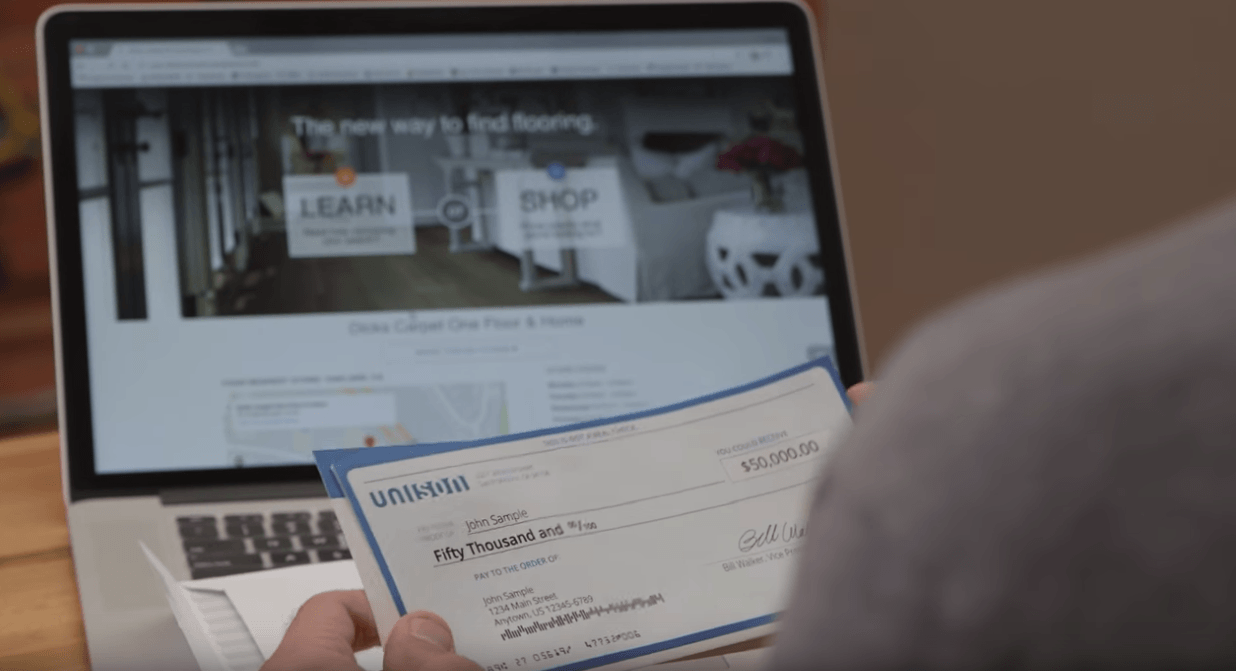

Around that time, Ed received a mailer from Unison which explained how homeowners like him could unlock their home equity through a Unison Equity Sharing Agreement. “I just so happened to get a mailer for Unison and I glanced at it, but I put it aside,” he said.

His first impression was that this looked too good to be true. There must be a catch, he thought. Later, he brought over a savvy friend to help him evaluate his options. The friend, who is a practicing lawyer, examined the details more closely and realized it could be a perfect fit for Ed.

“When he showed up, I let him look at the Unison mailer. He kept looking at it and reading the fine print that most of us don’t read, and he started going ‘Wow, this looks pretty good.’ I confirmed it with him and a few other [people] and it made sense.”

With that, Ed was ready to use a Unison Equity Sharing Agreement to pay off his debt.

Paying Off Debt and Remodeling the Home

After speaking with a Unison Program Specialist, Ed realized that by unlocking his home equity he would not only pay off his credit card debt — he would also be able to make important renovations on his home.

“Once we did get on board with the Unison concept, I realized I would be able to pay off my debt and have extra money to do something with, [so] we committed to pay cash for the first time ever for flooring for my entire house,” said Ed. “It’s going to be like a new house inside.”

Ed and his family are so excited with how their home looks and are grateful for the opportunity to remodel it and turn it into the home they’ve always wanted. Not only that, but Ed feels a sense of relief now that his debt is paid off in full.

“I was just hoping to pay off my debt and have that breathing room monthly. And I’ve done that and I’m doing a lot more for my house and for my family. It’s awesome.”

Disclaimer: This content is provided for general informational and educational purposes only and is not intended to serve as financial, investment, legal, tax, or lending advice. The information presented may not apply to your specific situation, and actual outcomes can vary based on individual circumstances, market conditions, and applicable laws. Home equity sharing agreements and loans involve risks, including the potential loss of future home appreciation or other financial implications. Terms, availability, and eligibility for any products mentioned may differ by state, lender, or other factors. We strongly recommend consulting with a qualified financial advisor, attorney, or licensed professional before making any decisions or entering into agreements. Unison Mortgage Corp. is a licensed lender (NMLS ID 2574289); this article may include promotional content related to its services.